In agrē, every unit of product requires a cost. Costing determines how your inventory is valued.

Unit Costing is per Product Code by Location (so 46-0-0 in Dog River can have a different cost than 46-0-0 in Edmonton). There is no "company" cost.

The unit cost is used to value the item throughout its inventory lifecycle - from Purchase Order (optional) to Inventory Receipt to Purchase Invoice.

What makes it a bit tricky is that a unit doesn't necessarily have the same cost from start to finish. When a unit cost is adjusted, agrē will not only use the updated cost from then on, it can go back in time and recalculate past transactions based on the new cost.

Until the unit is sold, its value is held in an Accrual Account. At the time of sale (and it's not a sale until it's on an invoice), its value is transferred to Cost of Goods Sold (COGS)

What you'll find:

Transactions That Move Inventory (in or out) and Affect Costing

Inventory Receipts: Inventory items can be purchased or returned.

Location Transfers: Inventory items are moved from one location to another. GL Postings are not made since all locations in a company use the same Inventory Asset account.

Manufacturing: Raw products are used to make a new inventory item. The new inventory item is sold as one manufactured product and not as each individual product that makes up the manufactured product. agrē automatically updates the cost of the raw products and, as a result, the manufactured product, when applicable.

Inventory Adjustments and Manual Counts: Inventory items can be moved in or out of your inventory (i.e. items missing or broken). You must specify costs for any inventory items that are moved into your inventory.

Loadout Tickets: Inventory items can be moved in or out of your inventory. Loadout tickets record inventory movement only (no invoicing).

AR Invoices: Inventory items can be purchased or returned.

Note

You can view an Inventory Cost History report for any inventory item.

Types of Costs

Unit Cost is the cost of one Main Unit of product (based on Product Code) from a particular Location.

FIFO Cost (First In, First Out) is the cost of the oldest unit in inventory being recognized as the unit cost. It is the oldest cost the from Cost History table.

Average Cost sums the cost of all units received at a location, divides that value by the total number of units, then uses that as the unit cost.

Cost of Goods Sold (COGS) is the Unit Cost recorded in the General Ledger at the time of sale (units sitting in inventory have no COGS value because they aren't sold yet). When sold, the unit cost value moves from the accrual account to the COGS account.

Base Cost is the initial unit cost from the Purchase Invoice, Inventory Adjustment or Transfer. It is sometimes referred to as the Original Cost.

Adjusted Cost is the unit Base Cost plus unit Cost Adjustments - premiums and/or discounts included in the unit cost. Cost adjustments can increase or decrease the Base Cost. Examples of cost adjustments could be shipping charges added to the cost of the item instead of posted to a general freight expense account, or volume discounts from manufacturers that reduce the unit cost.

Actual Cost is the last Adjusted Cost.

Estimated Unit Cost

Until you get an actual purchase invoice from the supplier - which gives you an actual cost - you technically don't owe anything, so there is no cost. But in real life, you know it's coming and you likely want to plan for it. You have two opportunities to give agrē an estimated cost to work with. You can set it on the Purchase Order, or you can wait until the units arrive on an Inventory Receipt. This estimated cost is what agrē will use as the unit cost in all costing calculations until it gets an Actual Cost. You can use any cost as the estimated cost. It could be $0 (costing at $0 may also be a flag to remind you to look up a cost or to forecast a better one). It could be the price on the supplier's website or a special one you negotiated with them.

Last Cost

The estimated cost could also be the Last Cost, which is the most recent cost from the Cost History table for that item at that location. You can find the Last Cost by running the Cost History Report, or by editing the product and checking the Inventory tab (if you've checked Update Estimated Cost with Last).

Next PO Cost

(Config C) agrē can Use Next PO Cost - if there's a PO available for the item at that location - as the estimated cost. If costs are fluctuating or you haven't purchased any units in a while, the Next PO Cost might be closer to the actual cost than the Last Cost.

Location Based Costing

With location based costing, Unit Costs are recorded and associated with inventory items at each location in your company, but there is no "Company" cost.

agrē Costing Methods

FIFO Costing

Unit Costing is based on the FIFO (First In, First Out) method: the items received into inventory first are moved out of inventory first (i.e., the oldest items in inventory are sold first).

Average Costing

Unit Costing is based on the Average Cost method: average cost = total $ value of items / quantity. Can be used for a single product only, or multiple.

How agrē Determines a Product Unit Cost

agrē automatically creates and updates a “Cost History Table” for each of your inventory items. The Cost History Table records the quantities, dollar values, and movement of all your inventory items. Each time you receive inventory items, agrē records the quantities and the costs of the items in the table. (Quantities are automatically converted to main units for costing purposes.)

When inventory items move out of your inventory, agrē records the number of units moved out and the cost. For example, if 10 units of a product are received at $15.00/unit (based on the cost specified on the purchase invoice) and then at a later date another 10 units of the same product are received at $10.00/unit, agrē records a row in the table for each time the product is received into your inventory. If 15 units of the product are sold, agrē records that 10 units of the product were sold at $15.00/unit and 5 units were sold at $10.00/unit. The Cost History Table then records that 5 units of the product at $10.00/unit are still available.

agrē continues to “use up” the product in the Cost History Table until there isn’t a quantity or cost for the product left to reference. When this occurs, an estimated cost is used.

Estimated Product Unit Costs

When Estimated Costs are used

Estimated Costs are used only in the following situations:

items are sold into the negatives (i.e., agrē has nothing left to reference in the Cost History Table).

items are received into your inventory for the first time and they do not have any costs associated with them yet.

the actual costs for items are not indicated on their inventory receipts.

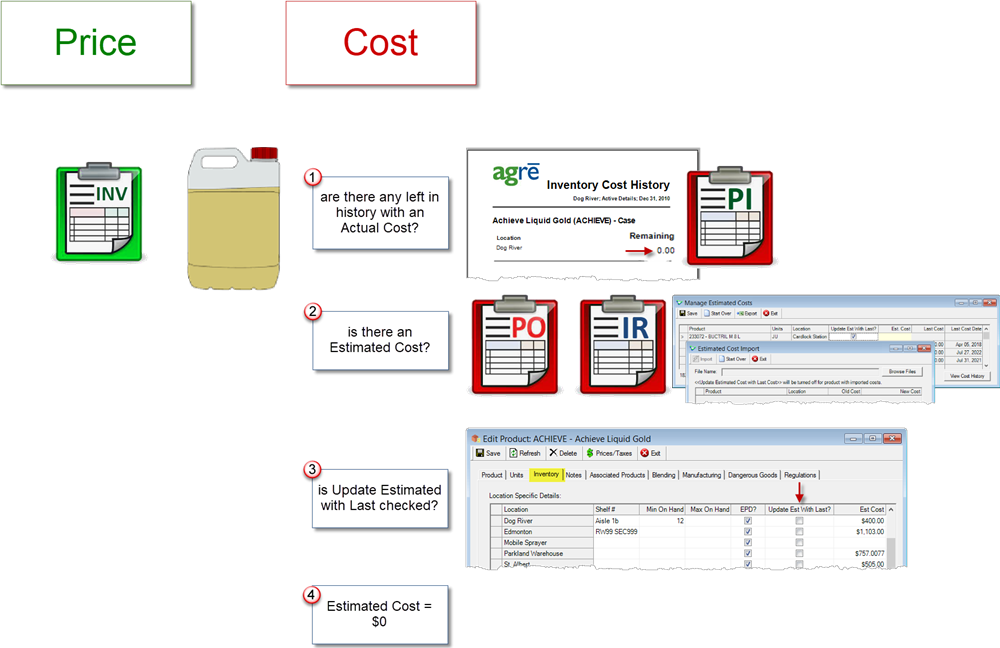

In order to obtain an estimated cost, agrē checks the following:

How agrē Determines an Estimated Unit Cost

agrē will determine the estimated cost of a product by checking the estimated costs fields for the product.

Note

(Config C) You also have the option to use the cost on the next available PO as the Estimated Cost.

Do you have an estimated cost specified for the inventory item? (refer to the second question in the flowchart shown above)

You can manually specify an estimated cost for any inventory item. This would be the cost you want agrē to use when an estimated cost is required.

Is the Update Est With Last? check box selected?

You can also specify that agrē automatically update the declared estimated cost with the last known cost (i.e., the cost of the item from when it was last moved into inventory at that location).

If neither of the above is specified, agrē will use an estimated cost of $0.

e.g. a product unit is sold - Price is posted to Revenue general ledger account, and Estimated Cost is posted to Cost of Goods Sold

When an estimated cost is used for a transaction, agrē will wait for an actual cost to be specified on a purchase invoice for that specific product received at that particular location.

Automatic Recosting

Once an actual cost is specified, the estimated cost is replaced with the actual cost and all relevant postings using the estimated cost are reversed and reposted with the actual cost. This is known as automatic recosting.

For example, an inventory receipt is being billed on a purchase invoice, but the estimated cost of the inventory item on the Inventory Receipt is different from the actual cost on the Purchase Invoice. All prior postings related to the movement of that inventory item are automatically adjusted when the purchase invoice is saved. Any future sales of the inventory item use the actual cost.

(Config C) Changes may be made to costs in closed accounting periods: the closed period is automatically re-opened and closed again. When agrē updates postings made to closed account periods, a message indicating the update appears in the Message Centre (for applicable users only).

Automatic recosting ensures that the proper postings and margins are intact and your subledger remains balanced.

Balanced Subledger

Each of your inventory items are associated with an Inventory Asset account (asset accounts are not location based). Any time an item moves in or out of your company, the quantity and dollar value of it is recorded and a GL posting is always made to the appropriate inventory asset account. Additionally, agrē uses Inventory Accrual Accounts to hold the value of any unbilled inventory movement.

For example, agrē records the value of inventory items on inventory receipts and loadout tickets. COGS accounts are also used to record the cost of sales, when an inventory item is invoiced to a customer. This ensures a balanced subledger: the value of the inventory on hand matches the inventory asset value in your GL. You also have access to a full audit trail of the costs used for each inventory item.

Rounding can cause your subledger to be off by a few cents; this is normal. It can be corrected in your GL at fiscal year end.

Cost Reporting

Cost History

agrē records the value (estimated or actual) of each unit of incoming inventory in a database table, and keeps track of which units are still in stock. You can view the 'report version' of this table with the Cost History report. The Cost History white paper explains the report in detail and goes through several examples of inventory movement and the costing implications.

Current Value

The Current Value report adds up the unit costs at each location as of a particular date. In a perfect world, the value of your inventory is the sum of the units multiplied by their cost: 5 units costing $100 each have a current value of $500. That's easy! However, since the real world is rarely perfect, it isn't always that straightforward. The Current Value white paper explains why costs may not always be what you think, and how you might be able to get them more in line with what you were expecting.

Customer Sales

Running the Customer Sales report with Show Margins checked displays the cost of each unit sold (i.e. the COGS value for each invoice), compares it to the price charged, and calculates the margin.

Product Prices vs Cost

The Product Prices vs Cost data export compares multiple unit prices (for example, Company, Location, Minimum) with different costs (like Estimated, Last).

Related Topics